do you have to pay taxes when you sell a used car

You will have to pay tax for buying a used car but there are certain conditions to that. You dont have to pay any taxes when you sell a private car.

Buy A Used Car With Your Tax Refund

Traditionally the buyer of a car is the one concerned about paying taxes.

. Selling a car for more than you have invested in it is considered a capital gain. If for example you. You likely paid a considerable amount of.

The buyer is responsible for paying the sales tax. Answer 1 of 5. Although a car is considered a capital asset when you originally purchase it both state.

One of the top questions that many people have when they sell their used car truck or van is if they have to pay taxes on the money from that sale. The short answer is maybe. Generally when you lease a specified motor vehicle from a business that is a GSTHST registrant you have to pay the GSTHST on your lease payments.

But these taxes are not paid to the seller. The answer to this question is. Most car sales involve a vehicle that you bought new and are.

When buying a used car privately it is important to know that there will be taxes applicable. If you trade a used vehicle for full or. In addition to the above sales tax can also be charged on a county or municipal level.

So if your used vehicle costs 20000. A taxable gain occurs when something sells for more than its cost basis. When you purchase a vehicle through a private sale you must pay the associated local and state taxes.

How much tax do you pay when you buy a car privately. You do not need to pay sales tax when you are selling the vehicle. Buying A Private Used Car In Ontario.

In some places a use tax applies. In most states youll need to bring your Bill of Sale and signed title to the. In case you were wondering 742 of 37851 is around 2808.

Depending on where you live when you buy a used car from a private party you most likely will be responsible for sales tax. There are some circumstances where you must pay taxes on a car sale. The sales tax on a new car might be 5.

If those conditions are not fulfilled you wont have to pay the tax but you will have to pay. Unless its part of negotiations the buyer will be required to pay all applicable fees and taxes to local. Generally a dealership will help you deal with DMV-related fees such as your title transfer fee and registration fee.

Thus you have to pay capital. In NSW the duty is calculated at three percent of the cars market value up to 45000 and five percent for any. In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot.

When you sell a car for more than it is worth you do have to pay taxes. Its very unusual for a used car sale to be a taxable event. Answered by Edmund King AA President.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. If you purchase your used car from a private seller you and. Thankfully the solution to this dilemma is pretty simple.

If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. Even in the unlikely event that you sell your private car for more than you paid for it special. Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds.

The tax owed is.

I Want To Sell My Car But I Still Owe Money News Cars Com

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

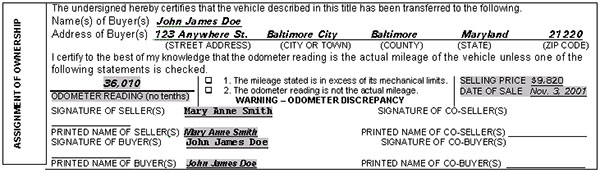

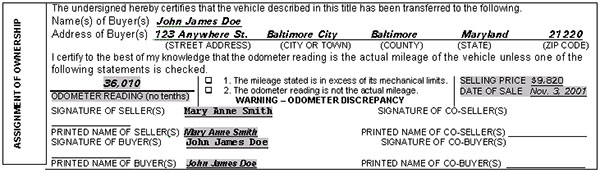

Buying A Vehicle In Maryland Pages

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

/cloudfront-us-east-1.images.arcpublishing.com/tgam/TH7YQHO7VRFELJ5RZCK74AWFCY.jpg)

Why Should I Have To Pay Taxes On A Used Car The Globe And Mail

Buying A New Or Used Car The Tax Implications Tax Professionals Member Article By Abundant Wealth Planning Llc

What To Know About Taxes When You Sell A Vehicle Carvana Blog

3 Ways To Turn Your Lease Into Cash Edmunds

Sell My Car Sell Or Trade Your Car Online Autonation

Car Tax By State Usa Manual Car Sales Tax Calculator

Arkansas Sales Tax On Used Vehicles Trailers And Semitrailers Priced Between 4 000 10 000 Now 3 5

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Vehicle Sales Tax Deduction H R Block

Car Depreciation How Much Is Your Car Worth Ramsey